OVERHEAD ALLOCATION

Overhead Allocation Accounts - Additions to Chart of Accounts

Let's start with two strong suggestions, which will apply no matter the allocation model selected --

First --

To make the effort of allocation worthwhile, you must push as many expenses as reasonable to the individual jobs. You will continue to push expenses to the individual jobs until you reach the point where the

B(oa) < C(oa)

or the

Benefits of Overhead Allocation is less than the Costs of Overhead Allocation.

Beyond that, it makes no sense to continue allocating individual expenses.

There will be a different benefit breakeven level for each business or business owner. Some business owners will measure the time taken to estimate jobs and allocate those costs, or will bill out management time on a per job basis. Other owners will allocate only direct expenses to the job level, and aggregate overhead expenses to be batch-allocated by some model.

The crux of the issue is to remember that the reason we want to allocate overhead is to derive useful information to assist us in managing the business. We do not allocate paper clips because it makes no sense to track allocation to that degree. But any level of direct allocation above that is up to the individual business owner.

Our businesses do not work for the accountants, the accountants work for our businesses.

Second --

Speaking of accountants, you must add two accounts to your Chart of Accounts, if you do not already have them.

Add an account to your expenses category, as the last account in that category, titled "Indirect Expenses Allocated". In my Chart of Accounts, this is account "4990 - Indirect Expenses Allocated".

Add an account to your Cost of Goods Sold (COGS) category, as the last account in that category, titled "Overhead Allocations". In my Chart of Accounts, this is account "3990 - Overhead Allocations". This account will be the control account where you will aggregate the individual jobs to which you have allocated the overhead expenses.

The Transaction

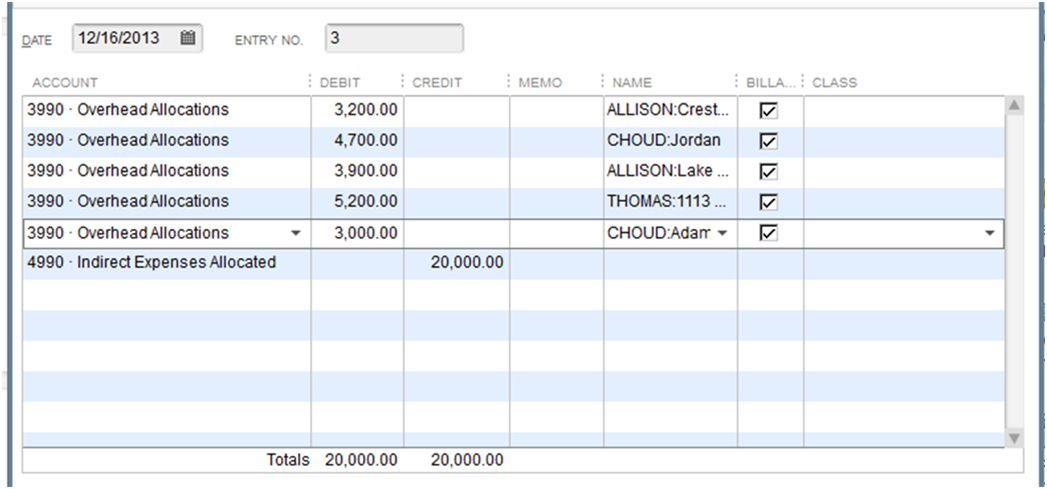

Following is the process for the actual allocation (assuming you wish to allocate $20,000 of overhead expense to five jobs)--

In the General Ledger--

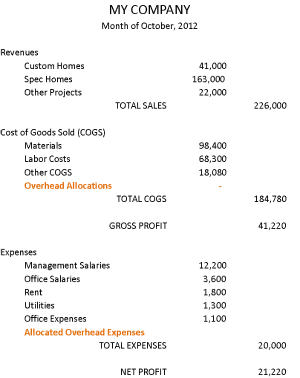

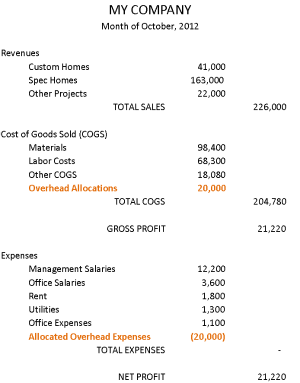

And the effect on the Income Statement --

|

BEFORE  |

AFTER  |

Note the changes in the highlighted account from the first statement to the second.

The purpose of these two accounts is to monitor the amount of Overhead Allocation during the period. Because we are using separate accounts, the balances of the individual line items such as Management Salaries, Utilities, Rent, Materials, or Labor Costs have not changed, but the overhead costs can be distributed to the individual jobs. It is important not to change the individual line items mentioned because several of them are used in important financial metrics we will discuss under Financial Ratios elsewhere in this site.

Note also that the overall Sales - Expenses = Profit relationship does not change. Employing the two extra accounts simply moves the funds from one category to another within the Expense Category.