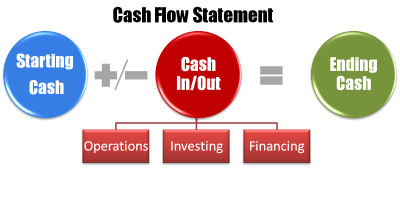

THE CASH FLOW STATEMENT

The Cash Flow Statement = Your Checkbook

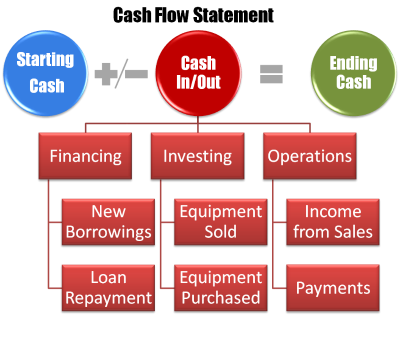

The Cash Flow Statement is the easiest financial statement to comprehend. It documents the money that your business had at the start of a period, the money that came into your business during that period, the money that went out of your business during the period, and how much was left at the end of the period.

The period could be a year, a quarter, a month, a week or a day, depending on what time frame you want to measure.

Think of the Cash Flow Statement as an organized checkbook.

Develop a Useful Cash Flow Statement

- Step 1 -

|

The statement to the right is a perfectly fine Cash Flow Statement. It shows the amount of money in the business at the start of the month, how much came in, how much went out, and the ending cash in the business. It meets the requirement for a Cash Flow Statement, but it isn't useful. The only thing we know from this statement is that more cash came in than went out, so we have more money at the end of the period than we did at the beginning. That's a good thing, but... To really get control of the business, we need to know where the money came from and what it was spent on. We need to know if the money coming in was from work the business did or if it was borrowed and has to be paid back. We need to know if the money that went out was spent on an asset, on building the business, on paying materials bills or for the 4th of July party. We need more detail. |

CASH FLOW STATEMENT Sunrise Construction For Month of July, 20XX

|

- Step 2 -

|

OK, now we're getting somewhere. It appears that $92,000 of the $98,000 that came in was from operations. About 94% of the inflow was produced by the business. It also appears that operational inflows exceeded operational outflows by about 31%. While a positive sign, we can't really draw any conclusions without looking at the Income Statement to see what it shows about Sales and Costs and the Net Worth Statement to see what it shows about Accounts Receivable and Accounts Payable. If those numbers stayed steady, it looks like we are making money. We need one more level of information to make this Cash Flow Statement a useful business management tool. Good information is available in this statement, but we are still operating at fly-over level. The next step gets us on the ground. |

CASH FLOW STATEMENT Sunrise Construction For Month of July, 20XX

|

- Step 3 -

|

Now we are at the management level. And now we know much more about how the month went for Sunrise Construction. I have always found that I get the most information from the financial statements by telling myself the story as written in the statement. The story of Sunrise Construction would go like this... "Nice. They brought in $14,000 in cash. That means that they don't have to wait for their money and can use it right away." "Hmm. Accounts receivable was reduced by $78,000. Going to have to look at their Income Statement for the month to see if they were able to replace that with sales. If not, there may be a cash squeeze coming down the line unless they hoard some cash." "Well, he must not be too worried. Bought a truck.. must feel okay about the future ...or has a son just starting high school." "Look at that. Paid $24,000 in cash for materials. Bet he got a real break on cost for that. That should show up as more profit on the Income Statement in the near future." "Reduced his Accounts Payable by a good amount, too. I need to check the Net Worth statement to see how the trend is looking for the Accounts Payable. See if he is reducing the Accounts Payable as a percent of Accounts Receivable. That would be a real good sign." "Spent $11,000 for the truck. Must have been used. That should show up in the Assets section of the Net Worth Statement." "Reduced the Line of Credit by $3,000.00. That will make more cash available for the future if needed, and it will make his banker happy to see the activity." "Took care of materials needed, bought another truck, met the payroll, paid down the Line of Credit by a little, and increased Cash on Hand by $14,000. It looks like it was a good month. He's doing all the right things." |

CASH FLOW STATEMENT Sunrise Construction For Month of July, 20XX

|

Controlling Your Cash Flow

If you are using an accounting program, it should be a snap to get your current Cash Flow Statement. Print one out now, and see what story it tells about your business.

If you are not yet using an accounting program, I have prepared a download that will assist you in preparing your Cash Flow Statement. Get your checkbook register and enter the information from your stubs in the appropriate spaces. Remember, INFLOW is cash coming into your account; OUTFLOW is cash going out of the account.

The download consists of two Cash Flow Statement formats. The first is the "Checkbook" format which I have shown above. This format displays the TOTAL INFLOWS vs. TOTAL OUTFLOWS.

The second is a "Category " format which produces the same result, but displays net changes in Operations, Investments, and Financing. This format displays the Operations Inflows vs Operations Outflows, Investment Inflows vs. Investment Outflows, and Financing Inflows vs. Financing Outflows.

Both formats are useful as management tools.

I would encourage you, even if you are using an accounting program, to go through the process of building your Cash Flow Statement. You will have a much better understanding of what the numbers mean if you put in the exercise. And the Cash Flow Statement will be a tool instead of some mystical report your accountant produces and nobody ever reads.